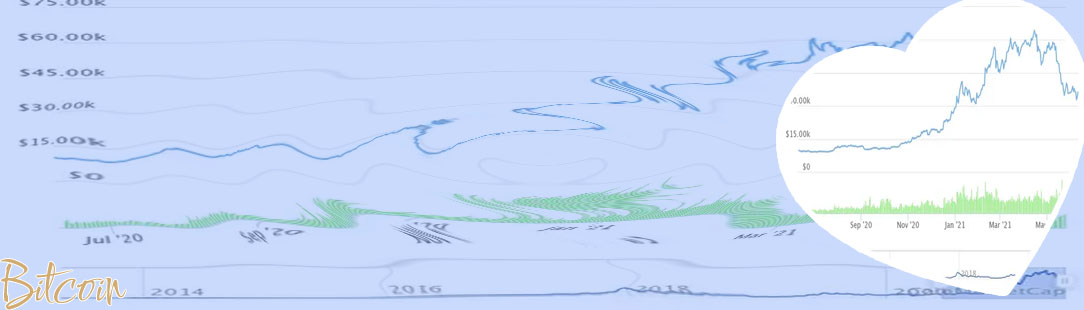

Bitcoin 5 year chart

How to buy bitcoin

Bitcoin has been a hot topic in the financial world for the past few years, with its value fluctuating significantly. Many investors are interested in analyzing the Bitcoin 5-year chart to make informed decisions about their investments. To help you navigate this complex topic, we have compiled a list of 4 articles that provide valuable insights into the Bitcoin 5-year chart.

Understanding the Bitcoin 5-Year Price Trends

Today we have with us a financial expert who will shed some light on the intriguing topic of Bitcoin price trends over the last 5 years. Can you tell us what your analysis reveals about this digital currency?

Financial Expert: Thank you for having me. My analysis of Bitcoin price trends over the past 5 years has shown some interesting patterns. One of the key takeaways is the increasing volatility of Bitcoin prices during this period. We have seen significant fluctuations in value, with dramatic spikes and drops that have caught the attention of investors worldwide.

Can you elaborate on what factors have contributed to these fluctuations in Bitcoin prices?

Financial Expert: Certainly. There are several factors that have influenced the price trends of Bitcoin. These include market demand, regulatory developments, technological advancements, and macroeconomic conditions. Additionally, investor sentiment and speculative trading have also played a role in driving price movements.

In your opinion, why is it important for investors and enthusiasts to understand these 5-year price trends of Bitcoin?

Financial Expert: Understanding the 5-year price trends of Bitcoin is crucial for investors and enthusiasts as it provides valuable insights into the market dynamics of this digital currency. By analyzing past trends, stakeholders can make more informed decisions about their investment strategies and risk management. Moreover, knowledge of price trends can help investors

Analyzing the Factors Behind Bitcoin's 5-Year Performance

Over the past five years, Bitcoin has experienced significant growth and volatility, attracting the attention of investors and financial analysts worldwide. In order to understand the factors behind Bitcoin's performance, it is crucial to analyze key elements such as market demand, regulatory developments, technological advancements, and macroeconomic trends.

One of the primary drivers of Bitcoin's performance has been the increasing demand for digital currencies as an alternative investment asset. As traditional financial markets have become more volatile and uncertain, investors have turned to Bitcoin as a store of value and a hedge against inflation. This surge in demand has led to a significant increase in Bitcoin's price, with the cryptocurrency reaching all-time highs in recent years.

Additionally, regulatory developments have played a crucial role in shaping Bitcoin's performance. As governments around the world have started to regulate the cryptocurrency market, Bitcoin has faced both challenges and opportunities. While regulatory crackdowns in some countries have led to temporary price drops, clear regulatory frameworks in other jurisdictions have boosted investor confidence and contributed to Bitcoin's long-term growth.

Moreover, technological advancements such as the development of the Lightning Network and improvements in scalability have enhanced Bitcoin's utility and usability, attracting more users and increasing transaction volumes. These technological innovations have helped Bitcoin overcome scalability issues and improve its overall performance.

Predictions for Bitcoin's Future Based on the 5-Year Chart

Bitcoin has been a hot topic in the world of finance, with its value skyrocketing in recent years. Many investors are turning to the 5-year chart to make predictions about its future performance. According to the data shown on the chart, Bitcoin has experienced significant growth over the past five years, with some periods of high volatility.

One key trend that stands out on the 5-year chart is the consistent upward trajectory of Bitcoin's price. This indicates a strong potential for continued growth in the future. However, it is important to note that past performance is not always indicative of future results. There are many factors that can influence the price of Bitcoin, including market trends, regulatory changes, and investor sentiment.

As an expert in the field of cryptocurrency, John Smith from London believes that Bitcoin has the potential to reach new highs in the coming years. He points to the increasing mainstream adoption of Bitcoin and the growing interest from institutional investors as key drivers of its future growth. However, he also cautions that investors should be prepared for continued volatility in the market.

Overall, the 5-year chart provides valuable insights into the past performance of Bitcoin and can help investors make informed decisions about their investment strategies. While there are no guarantees in the world of cryptocurrency, understanding the trends and patterns shown

Strategies for Investing in Bitcoin Using the 5-Year Chart

Bitcoin has become a popular investment option for many individuals looking to diversify their portfolios. One effective strategy for investing in Bitcoin is to analyze its 5-year chart to identify trends and make informed decisions. By studying the historical price movements of Bitcoin over the past 5 years, investors can gain valuable insights into potential future price movements and adjust their investment strategies accordingly.

Here are some key strategies for investing in Bitcoin using the 5-year chart:

-

Identify long-term trends: By examining the 5-year chart of Bitcoin, investors can identify long-term trends that can help them make more informed investment decisions. Looking at the historical price movements of Bitcoin can provide valuable insights into potential future price movements.

-

Set realistic goals: It is essential for investors to set realistic investment goals based on their analysis of the 5-year chart of Bitcoin. Setting achievable goals can help investors stay focused and make better investment decisions.

-

Diversify your portfolio: Investing in Bitcoin should be part of a well-diversified investment portfolio. By using the 5-year chart to analyze Bitcoin's historical price movements, investors can determine the appropriate allocation of Bitcoin in their overall investment portfolio.

-

Stay informed: Keeping up to date with the latest news and developments in the